happy ten-year anniversary of GROSS TO JANUS

a visual essay re: the events ten years ago that led to my book

On Sept 25, 2014, I got a root canal. On Sept 26, I picked up my BlackBerry® to ask my boss if I could work from home (the swelling was worse than I’d expected; I looked like a Dr. Seuss character, proof here), but when I opened my email, I saw that I had 10,000 emails. Then I saw the headline. September 26, 2014 08:28 AM: WILLIAM H. GROSS JOINS JANUS CAPITAL.

The billionaire founder of the enormous money management firm I covered, almost the sole focus of my job as a beat reporter, had abruptly left his company for a much smaller competitor. It was a huge surprise. Which was, we would learn, his intent. ([X] TO JANUS would become a meme on FinTwit, which was maybe not his intent.)

On Oct 3, I flew to California to ~get the story.~

But — as you know if you read my book’s epilogue or listened to me talk — my trip was cursed: no one wanted to meet w me. It was terrible.

Here’s 2014 me, feelin desperate, in my lovely hotel room at the Delfina Santa Monica. (honestly love that place. It was a Bloomberg preferred hotel for LA trips iirc. But it was not convenient to Newport Beach. A source laughed when I told him where I was staying.)

Here’s some great shoe-leather reporting I did:

This is an authentic 2014 picture of the Pimco building. From the outside.

I had formidable competitors….

…Fashion Island is the mall next to Pimco HQ. It’s also where they film scenes for Real Housewives of Orange County.

I, too, went to Fashion Island. Sometimes alone, which is, as you can see in this picture, extremely dangerous:

This is a REAL BIRD trying to kill me for my sandwich crumbs. I fled.

In 2014 (and later) I would sit at the Starbucks on Fashion Island to work, because it was obviously often a convenient meeting spot, and periodically guys in suits would get in line to order their early-afternoon coffee, notice me, and jump out of their skin. It felt like there was a wanted poster with my face on it in the Pimco building.

I went for a run on the Santa Monica beach. I’d never seen Venice so I ran that way. During this run, a source (finally) called. I put myself on mute while he talked and I caught my breath.

….over these singular days and the subsequent weeks, I chipped away at the will of people who flagrantly did not want to tell me What Really Happened at Pimco; I listened to stretched-thin narratives from people with an agenda; I talked to people who didn’t know What Really Happened but had some shred of information, a little piece that had fallen off the larger context. I gathered all that up and put it together piece by piece to see the whole. It was so much fun. A masterclass in psychology and motivation and memory. In December — thanks to great assists from people including Bloomberg legend Kathy Burton— we published my What Really Happened story, which became the basis for my book.

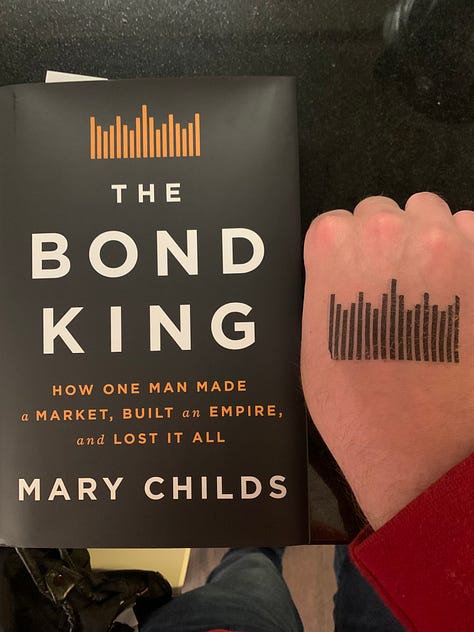

A source pointed this out: the book was published the day before the Federal Reserve started on its path of interest rate hikes, raising rates to fight a severity of inflation not seen since the 1970s -- approximately the moment when Pimco began. Isn’t that funny? My book’s publication put a PERFECT button on a 50+ year era of declining interest rates and rising bond prices. YES, I DID try to call my book “The Bond Age,” but my publisher did not entertain it.

Now, of course, the Fed has cut rates again. The timing did surprise me; I am myopic enough to think the rate cut would be at the end of the year, when my book finally comes out in paperback.

I am also myopically vindicated; when Jacob Goldstein and I chatted about money for Planet Money Plus, I put forward a theory I’d just discovered I had: that on a long enough timeline, interest rates are always trending towards zero. That this hiking cycle would be a blip. This was more an emotional theory than an empirically robust one1 — the underpinnings were basically (technology advancing + [once created, wealth wants to beget more wealth]). Of course I am one of those millennials the old guys fretted about, who’d only ever experienced falling rates/rising prices and didn’t know about the other direction (the worry being that those babies wouldn’t know how to trade a bear market). So to a large degree this is inexperience abstracted. Still, it was surprising and delightful to unearth this apparently stubborn conviction that the Fed’s hikes wouldn’t do that much, would possibly even be ignored (!!??!).

We also posited in a Planet Money episode that the “vibe shift” was inflation. I think now it was inflation and rising rates. Larry Summers said we were all mad at the good economy because of the pain of high rates; I agree, levels matter. But direction, rate of change?? Rising rates feel so bad!!!

So on two axes I am personally thrilled rates are coming down. It means we will all definitely become happy, and it gives the theory I found embedded in my subconscious a chance — which could mean that capital will again slosh through the streets and subsidize our taxi-ripoff rides and flow to very goofy things but also great things, and Bill Gross will again be on TV saying it’s bad for savers. I feel better already.

maybe you have more formal findings on hand. as always, please feel free to point me to the good research!